Auto Insurance in and around Omaha

The first choice in car insurance for the Omaha area.

Time to get a move on, safely.

Would you like to create a personalized auto quote?

You've Got Places To Be. Let Us Help!

Driving is likely a common piece of your daily routine. Whether you drive a mini van or a sedan, you count on that vehicle to take you where you need to go, which is why excellent coverage for when the unpredictable occurs can be so vital.

The first choice in car insurance for the Omaha area.

Time to get a move on, safely.

Great Coverage For Every Insurable Vehicle

But there are lots of ways to get where you are going and move from Point A to Point B. State Farm also offers insurance for van campers, trail bikes, truck campers, mini-bikes and go-carts. Whatever you drive, State Farm has you covered and is ready to serve with great savings options and attentive service. Plus, your coverage can be personalized, to include things like rideshare insurance and Emergency Roadside Service (ERS) coverage.

Auto coverage like this is what sets State Farm apart from the rest. State Farm is there whenever trouble finds you on the road to handle your claim promptly and reliably. State Farm has coverage options to get you wherever you are going from day to day.

Have More Questions About Auto Insurance?

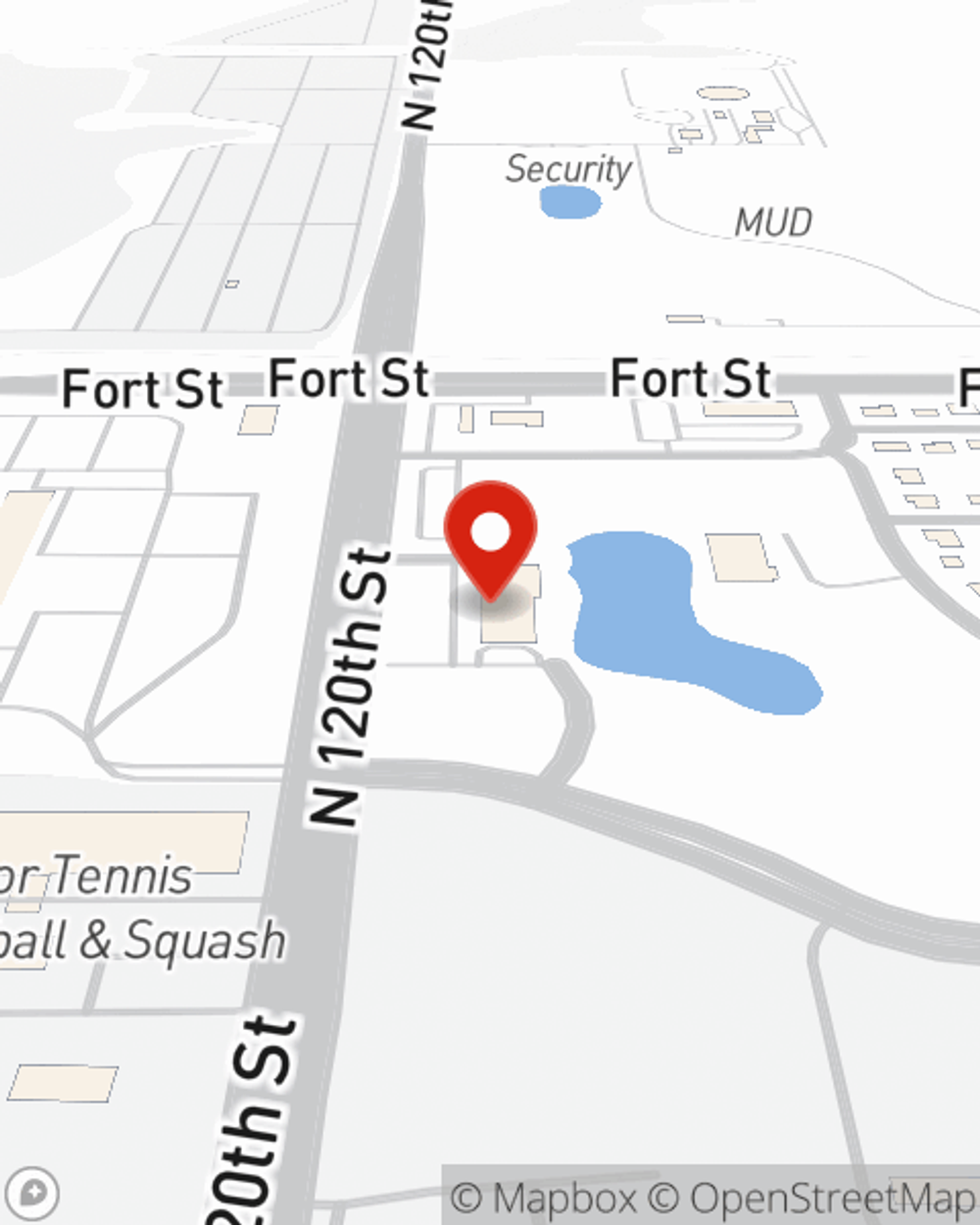

Call Sherman at (402) 493-1000 or visit our FAQ page.

Simple Insights®

How to check tire pressure

How to check tire pressure

Maintaining proper tire pressure is often overlooked by drivers until they need to swerve or brake unexpectedly. Find out how to check and maintain proper tire pressure.

Water ski and jet ski safety tips

Water ski and jet ski safety tips

Discover ways to water ski or jet ski safely and help avoid injury when skiing for the first time or as a refresher.

Sherman Willis

State Farm® Insurance AgentSimple Insights®

How to check tire pressure

How to check tire pressure

Maintaining proper tire pressure is often overlooked by drivers until they need to swerve or brake unexpectedly. Find out how to check and maintain proper tire pressure.

Water ski and jet ski safety tips

Water ski and jet ski safety tips

Discover ways to water ski or jet ski safely and help avoid injury when skiing for the first time or as a refresher.